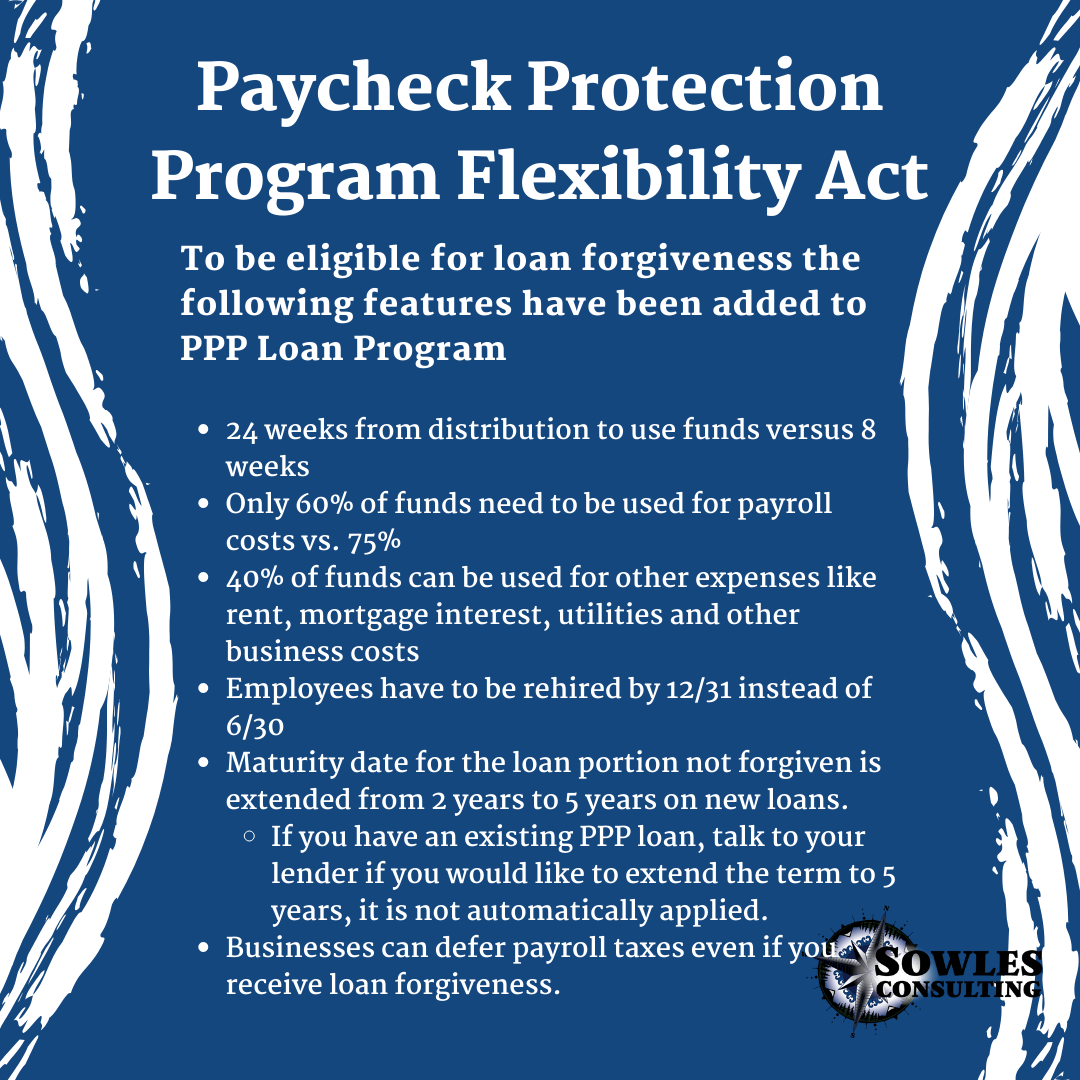

I know that a lot of you are facing all kinds of craziness right now. But I just wanted to share about the new features that were enabled by the Paycheck Protection Program Flexibility Act. The new legislation that was just signed by the President on Friday June 5, adds new features to the PPP loan program to make it easier to qualify for loan forgiveness. I know a lot of you have PPP loans already and are using them. If you haven’t applied yet for a PPP Loan you only have until June 30th to take advantage of this program. There is still PPP funding out there so, if you haven’t applied yet, you can contact lenders, not all of them are taking PPP loans, but I know there are still some out there that you can apply for the PPP.

For those of you using PPP loans currently, many of you are coming up against what used to be that eight week window to bring your people back and use those funds to qualify for loan forgiveness. The first feature of the Act will make a big difference for a lot of businesses because that eight week window to be eligible for the forgiveness portion of the law has been extended to 24 weeks. So, you actually have 24 weeks from the date you receive the loan funds or December 31, whichever happens first. This big change that’s huge for some businesses. I’ve talked to a couple businesses last week that we’re running up on their eight week mark and hadn’t yet used all of the funds or been able to bring all of their employees back yet.

Another factor with PPP flexibility is they have reduced the amount that you have to specifically spend on payroll costs to still be considered for loan forgiveness. On the original PPP loan funding, you had to spend 75% on payroll costs on wages, benefits, and/or state payroll taxes or for sole proprietors it’s your income. You now only have to spend 60% on payroll costs to qualify for the loan forgiveness.

So you have 24 weeks to spend the money that you get with your PPP loan and only 60% has to be spent on payroll costs for it to be considered for forgiveness. You can use 40% of your loan funds for rent, utilities, other business related expenses.

Another important change for small businesses, the maturity dates on the loans. If you have an existing PPP loan still a two year maturity, unless you talk to your lender. But all new PPP loans will have a five year maturity rate. So if you have an existing loan and you know you’re going to end up with a balance that will not be forgiven, you can talk to your lender, and you can mutually agree to extend it up to five years. But if you’re getting a new loan, five years will automatically be the payback.

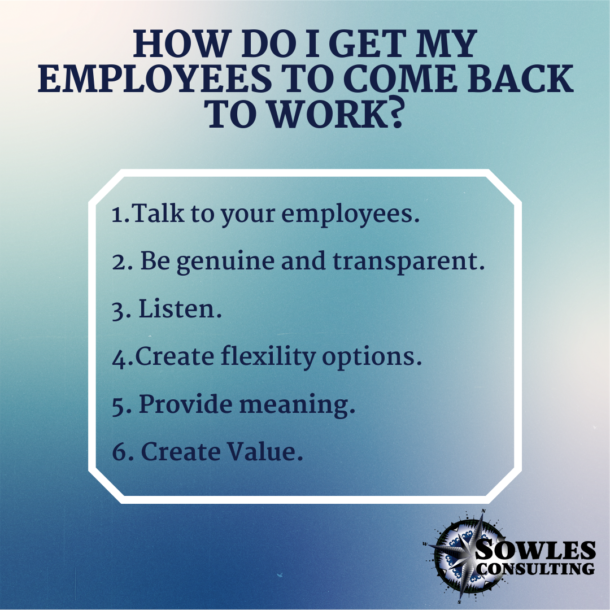

Those are the big changes with the PPP Flexibility Act. Last week I had a conversation with a business owner, whose employee was refusing to come back. There is an exclusion feature within the PPP Program for employees refusing to return to work. If you offer your employee their position back at the same rate of pay. And they refuse to come back. You need to document that so you provide the offer in writing, you document their response. The response does not have to be in writing but you do need to document the date, time, when you talked to them in person or on the phone. Once you have all of that documentation, then you have to notify within 30 days, the Employment Department that you offered them, and they refuse to return to work. The Employment Department then knows that they refuse to come back to work, in which case they lose their unemployment and are forced to go back to work.

If you are still looking to apply for the PPP loan, as of June 12th, I found these banks may be still accepting applications: (some are requiring that you were a small business customer prior to 2/15/20 but not all).

Bank of America

Capitol One

Citibank

Intuit-Quickbooks

PayPal(I heard they were really easy to work with and funding quickly)

Square

Umqua Bank

US Bank

If you have not already joined my Facebook Group created to be a resource for Small Business Owners you can join us at sowlesconsulting.com/group. The group is a great place to ask questions and gathering tips, information and a little humor.

Sowles Consulting offers a FREE 30 minute strategy session for all potential clients.

Book your free appointment with Tonya Sowles, CEO of Sowles Consulting today to begin the next steps in your business.

© Copyright 2022 Sowles Consulting, LLC.

All rights reserved.